If you’re considering buying a home, understanding home mortgage rates is key. These rates, which represent the interest charged on a home loan, directly impact monthly payments and the total cost of the loan. Rates are influenced by various factors, including market conditions, the lender, and your financial profile.

Fixed vs. Adjustable Rates

When choosing a mortgage, you’ll encounter two main types: fixed-rate and adjustable-rate mortgages (ARMs). A fixed-rate mortgage locks in a set interest rate for the loan’s life, making your payments predictable. ARMs, however, start with a lower introductory rate that can change over time, typically after a set period, often resulting in fluctuating payments. Fixed-rate mortgages offer stability, while ARMs may be ideal if you plan to sell or refinance within a few years.

How Mortgage Rates Are Determined

Mortgage rates are influenced by economic indicators such as inflation, employment rates, and Federal Reserve policies. Generally, when the economy is strong, rates tend to increase to keep inflation in check. Conversely, during economic downturns, rates may home mortgage rates drop to encourage borrowing and spending. Your credit score, down payment, loan amount, and loan term also impact your mortgage rate. Higher credit scores typically qualify for lower rates, as they represent lower risk to lenders.

The Role of the Federal Reserve

The Federal Reserve plays a significant role in influencing mortgage rates through its monetary policy. While the Fed does not directly set mortgage rates, it controls short-term interest rates and uses policy tools to manage inflation and economic growth. When the Fed adjusts rates, mortgage rates often follow, impacting borrowing costs across the housing market.

Comparing Mortgage Lenders

To secure the best mortgage rate, it’s essential to compare lenders. Different banks, credit unions, and online lenders offer varying rates and terms. By shopping around, you may find more favorable rates and save thousands over the life of your mortgage. Remember to compare the APR (Annual Percentage Rate), which includes fees and other costs associated with the loan, to understand the loan’s true cost.

The Impact of Credit Scores on Mortgage Rates

Credit scores play a pivotal role in determining mortgage rates. Lenders assess creditworthiness based on credit scores, which indicate the borrower’s history of repaying debts. Borrowers with high credit scores are often rewarded with lower interest rates, while those with lower scores may face higher rates or additional requirements. Improving your credit score before applying can significantly reduce the cost of your mortgage.

Down Payments and Their Effect on Rates

The size of your down payment can also influence your mortgage rate. A larger down payment reduces the lender’s risk, often resulting in a lower rate. While a typical down payment is around 20%, many lenders offer loans with lower down payment requirements. However, putting down less than 20% may require private mortgage insurance (PMI), increasing monthly payments.

Loan Term and Its Influence on Mortgage Rates

The length of your mortgage affects the rate. Shorter-term loans, such as 15-year mortgages, typically have lower interest rates compared to 30-year loans. While monthly payments are higher on a shorter-term loan, the total interest paid over the loan’s life is significantly reduced, saving money in the long run.

Mortgage Rate Trends

Staying informed about mortgage rate trends can help you make a more informed decision when choosing a loan. Mortgage rates fluctuate based on economic factors, so keeping an eye on these trends can provide insights into when to lock in a rate. Some experts recommend locking in a rate when they are historically low to secure affordable payments.

When to Lock in Your Rate

Locking in your rate means securing it at the current level for a set period, typically 30 to 60 days. This can be beneficial if rates are rising. However, if you believe rates might fall, waiting to lock in could result in savings. Many lenders offer rate-lock options, so it’s wise to discuss these with your lender.

Refinancing for Better Rates

If you already own a home, refinancing can be a smart way to take advantage of lower rates. Refinancing involves replacing your current mortgage with a new one, ideally with a lower interest rate. This can reduce monthly payments and potentially save thousands over time. However, refinancing costs should be considered to ensure it’s a cost-effective option.

Mortgage Rate Calculators

Using a mortgage rate calculator can help you estimate monthly payments based on different rates and loan terms. Calculators are widely available online and can provide insights into how changing the rate, down payment, or loan term affects your budget. These tools can be valuable for planning and comparing different mortgage scenarios.

Mortgage Points: Buying Down Your Rate

Mortgage points, also known as discount points, allow borrowers to “buy down” the interest rate. By paying an upfront fee, you can reduce the mortgage rate, potentially saving money over the loan’s life. Typically, one point costs 1% of the loan amount and reduces the rate by 0.25%. This option may be worth considering if you plan to stay in your home for an extended period.

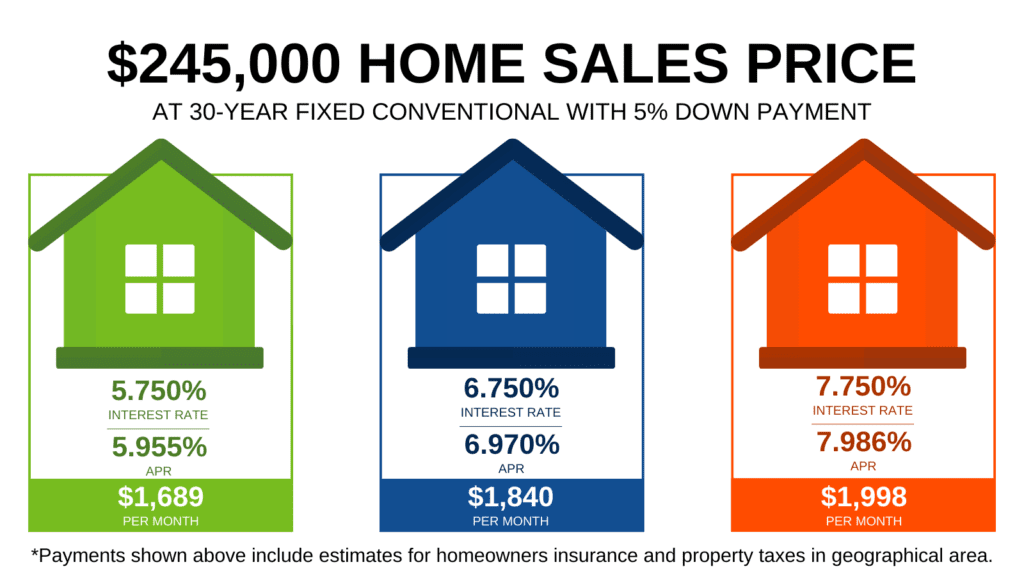

Understanding APR vs. Interest Rate

It’s essential to distinguish between the interest rate and the APR (Annual Percentage Rate). While the interest rate reflects the cost of borrowing, the APR includes other fees, giving a more accurate picture of the loan’s total cost. Comparing APRs can help you identify which loan offers the best overall value.

Getting Pre-Approved for a Mortgage

Getting pre-approved for a mortgage can streamline the home-buying process and give you a clear idea of what you can afford. Pre-approval involves the lender reviewing your financial information and providing a loan amount and potential interest rate. This can strengthen your offer when buying a home, as sellers view pre-approved buyers as more reliable.

Final Thoughts

Navigating home mortgage rates can be complex, but understanding these fundamentals can empower you to make informed decisions. By researching different lenders, understanding rate types, and improving your financial profile, you can secure a favorable mortgage rate. Whether you’re a first-time buyer or refinancing, knowledge is key to achieving the best possible outcome in your mortgage journey.

Conclusion

In conclusion, understanding home mortgage rates is essential for anyone looking to buy a home or refinance their current mortgage. These rates significantly impact your monthly payments and the overall cost of your loan, which means even a slight difference in rates can save—or cost—you thousands of dollars over time. The mortgage rate you qualify for is influenced by a range of, including your credit score, loan type, and economic conditions. Fixed-rate mortgages offer stability, ideal for those who plan to stay in their home long-term and prefer predictable payments. Meanwhile, adjustable-rate mortgages provide lower initial rates, which might appeal to those expecting to move or refinance before the rate adjusts. To find the best mortgage rate, it’s crucial to shop around and compare offers from different lenders.